SERVICES AND PRODUCT

Individual Portfolio Management

Individual Portfolio Management is a private portfolio management service offered to individuals and institutions to manage their savings by expert portfolio managers in the capacity of a proxy in accordance with management criteria to be determined by investors, like benchmark, portfolio distribution composition, financial products, and transactions that can be included in the portfolio.

A IPM service is offered to qualified investors with a portfolio size of 1 million TL or above through the “Framework Agreement for Personal Portfolio Management” signed between investors and Halk Invest.

IPM service is priced with a management fee (on the basis of the total portfolio size) and performance commission (on the basis of the benchmark).

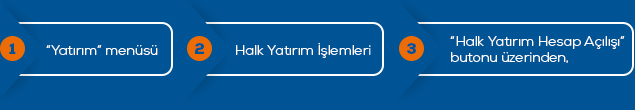

The IPM service process basically takes place through the steps below:

First, all criteria like investment targets, risks that can be taken, financial assets wanted and not wanted to be included in the portfolio, benchmarks with which our investors can compare portfolio performance, and all fees and commissions are set out in the agreement in detail.

Subsequently, portfolio managers start the portfolio management process according to the criteria specified in the contract and the asset distributions determined based on research and quantitative analysis are applied for the respective portfolio.

Later on, the performance of the portfolio is monitored instantly and all position changes and revisions required by market conditions are conducted as soon as possible by portfolio managers.